If you adopted a child during the taxable year, you can claim up to 50% of adoption costs paid. This credit is a nonrefundable tax credit. Taxpayers who make these contributions can claim up to 50% of their contributions on the tax return. The State of California allows taxpayers to contribute to a state tax fund, which provides financial aid for low-income students to attend college. The credit is a nonrefundable credit, which means it can only reduce up to the amount that you owe in taxes.

You can claim the child and dependent care credit if you paid someone to care for your child, a dependent or spouse. If you qualify for the young child tax credit, you may receive up to $1,000. You can also qualify for the Young Child Tax Credit if you have a qualifying child under the age of 6. The amount of the credit ranges from $243 to $3,027. You can claim the California Earned Income Tax Credit (CalEITC) if you work and have low income (up to $30,000), both credits are a refundable credit. California State Income Tax Credits Earned Income Tax Credit: The CalEITC or YCTC Tax Credits The State of California follows the same federal guidelines for IRA contributions. You can claim a deduction for the amount you contribute to an individual retirement account (IRA). The state of California allows for a disaster loss suffered in California. You can claim a casualty loss if you do not receive an insurance or other type of reimbursement for the property destroyed or damaged.

The damage must be sudden, unexpected or unusual from an earthquake, fire, flood or similar event.

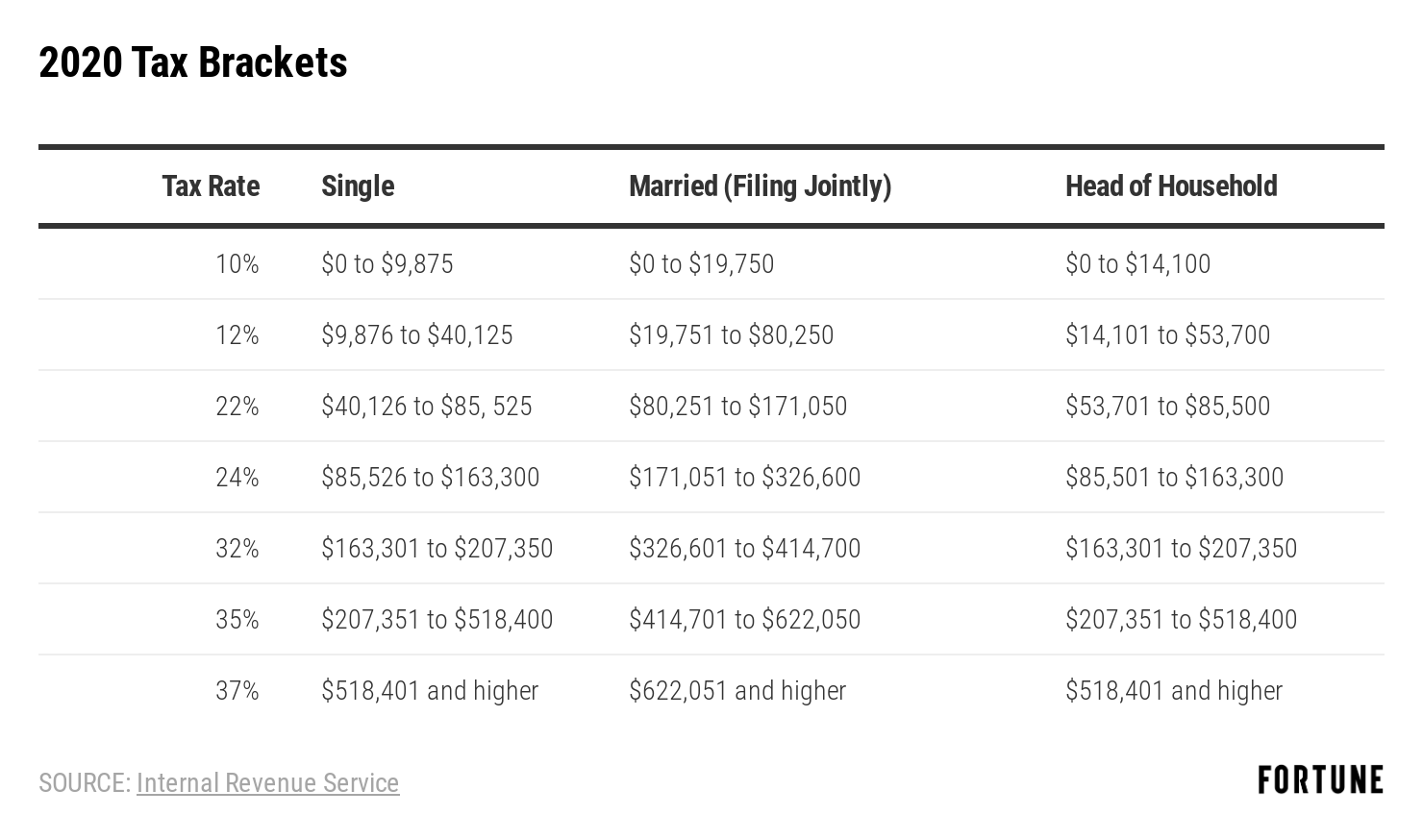

State Disability Insurance (SDI) Maximim ContributionĬalifornia State Personal Income Tax Rates and Thresholds in 2022 $0.00 - $8,544.00Ĭalifornia State Married Filing Jointly Filer Tax Rates, Thresholds and Settings California State Single Filer Personal Income Tax Rates and Thresholds in 2022 Standard DeductionĬalifornia State Personal Income Tax Rates and Thresholds in 2022 $10,000,000,000,000,000.00 - $16,446.If your California taxable income is over: California State Single Filer Tax Rates, Thresholds and Settings California State Single Filer Personal Income Tax Rates and Thresholds in 2022 Standard DeductionĮmployment Training Tax (ETT) Maximim Contribution If you would like additional elements added to our tools, please contact us. The California tax tables here contain the various elements that are used in the California Tax Calculators, California Salary Calculators and California Tax Guides on iCalculator which are designed for quick comparison of salaries and the calculation of withholdings for typical employees and employers.

#California tax brackets 2021 full#

The California State Tax Tables below are a snapshot of the tax rates and thresholds in California, they are not an exhaustive list of all tax laws, rates and legislation, for the full list of tax rates, laws and allowances please see the California Department of Revenue website. This page contains references to specific California tax tables, allowances and thresholds with links to supporting California tax calculators and California Salary calculator tools. Tax rates and thresholds are typically reviewed and published annually in the year proceeding the new tax year. The California Department of Revenue is responsible for publishing the latest California State Tax Tables each year as part of its duty to efficiently and effectively administer the revenue laws in California. We also provide State Tax Tables for each US State with supporting tax calculators and finance calculators tailored for each state. The California State Tax Tables for 2022 displayed on this page are provided in support of the 2022 US Tax Calculator and the dedicated 2022 California State Tax Calculator.

0 kommentar(er)

0 kommentar(er)